Abbreviations: 2SGMM: Two-step system generalized methods of moments; BSD: Banking sector development; CAR: Capital adequacy ratio; COFI: Cost of financial intermediation; ECTA: Eligible capital to total assets; GDP: Gross domestic product; ID: Income diversification; LLPTL: Loan loss provision to total loan; LSDV: Least square dummy variable; NLTA: Net loan to total assets; OLS: Ordinary least squares; OWNI: Islamic ownership; OWNP: Private ownership; ROA: Ratio of net income to total assets

1.

Introduction

Financing through capital is typically more expensive than other alternatives for banks. Again, the financial intermediation cost is the prime concern of banks to ensure profitability and long-run sustainability. However, regulatory compliance requires that banks have sufficient capital. Banks, as the financial intermediary, epitomize the focal conduit for moving capital (Otero et al., 2020) from supply units with an interest charge to deficit units by charging an interest margin in the global economy and economic system (Gupta et al., 2021). The global downturn of 2007–2008 severely hampered financial intermediation (Gertler et al., 2012). In response to the economic downturn, regulators worldwide made significant efforts to foster a functional banking system (Berger et al., 2021). This is because a well-functioning baking system promotes the expansion and enhancement of the economy (Levine, 1997). Regulatory authorities always strive to maintain and rebuild public trust in the country's financial system by implementing traditional and novel strategies to increase bank liquidity by emphasizing capital development (Lazopoulos, 2013). So, banks constantly strive to establish and maintain an optimal capital structure to maximize profit margins (Mehzabin et al., 2023) and firm value (Modigliani & Miller, 1958).

In a frictionless world, capital requirements begin with the market's imperfections (Modigliani & Miller, 1958). Although information plays a vital role in a perfectly competitive market situation, complete information consisting of a perfect market concept is impossible (Berger et al., 1995). Again, capital structure theories elucidate that the escalation of equity as a source of financing amplifies the weighted average cost of capital, which is knotted to the rising COFI to recoup the higher cost of capital (Rahman et al., 2018), and capital structure is influenced by both ownership structure and agency costs (Pushner, 1995).

Again, research evidenced that equity capital strengthens shareholder value by boosting investment projects' net worth while minimizing business risks (Gitman & Zutter, 2015). Higher capital requirements can enhance social efficiency by decreasing bank fragility (Archarya et al., 2012), leading to a higher COFI (Huang et al., 2019). Again, increasing capital requirements decreases shareholders' surpluses because of the need to search for deposit financing as the substitute for equity, forcing banks to increase the COFI to maintain the profitability level of the bank (Demirgüç-Kunt & Huizinga, 1999). Charging a higher COFI indicates inefficiency (Peia & Vranceanu, 2018), imperfect competition (Shawtari et al., 2019), poor information sharing, an inadequate legal environment of the business, and suboptimal risk management (Claeys & Vander Vennet, 2008). However, higher COFI, on the contrary, might provide an additional cushion against adverse shocks, resulting in increased profitability and a stable capital foundation for the banking system (Barajas et al., 2000), and for less developed nations, a relatively higher net interest margin is required for business viability through financial instability protection (Gorton & Winton, 1998).

Understanding the simultaneous relationship between bank capital and COFI is vital for policymakers and banking institutions. Despite the extensive literature on bank capital and COFI, there is a notable gap regarding the influence of ownership on this relationship. Different types of banks—state-owned, privately owned, conventional, and Islamic—operate under unique frameworks and regulatory environments, which may lead to varying capital requirements and COFI affairs. Moreover, this investigation centers on Bangladesh's emerging economy. Emerging nations are vital to the growth of the global economy (Bock & Demyanets, 2012), and their governments are profoundly dependent on bank finance to support their economic expansion (Vo, 2018). Like many other countries, Bangladesh's economy is mainly centered around commercial banking institutions (Gupta & Yesmin, 2022), indicating its status as a developing nation with a bank-based economy (Gupta & Sharma, 2023). This study aims to fill this gap by investigating how ownership impacts the relationship between bank capital and COFI, with potential implications for regulatory policies and banking strategies.

This research is significant for several reasons. First, it comprehensively analyzes how different ownership types affect the relationship between bank capital and the COFI, offering valuable insights for regulators and policymakers. By understanding these relationships, regulators can design more effective capital adequacy frameworks that account for ownership-specific characteristics. Second, the findings can help banking institutions balance capital and COFI based on different categories of COFI and capital. This enables banks to optimize their capital structures and COFI-generating tendencies, improving their performance. Finally, this study contributes to the academic literature by providing empirical evidence from an emerging economy, enriching the global understanding of banking practices.

Through analyzing debates and available literature, we intend to address the following inquiries: (ⅰ) How do capital and the cost of financial intermediation (COFI) mutually impact each other simultaneously, including any nonlinear effects? (ⅱ) Do private commercial banks and Islamic commercial banks have a significant effect on bank capital and COFI? And (ⅲ) How do ownership and COFI (capital) jointly impact the bank capital (COFI)? To address the above research questions, the primary objective of this study is to explore the simultaneous association between bank capital and COFI, with a specific emphasis on the influence of ownership. Using unbalanced panel data of 44 commercial banks in Bangladesh from 2010 to 2021, this study applies a 2SGMM approach, yields robust empirical findings, and provides valuable insights into the banking sector within an emerging market context.

This article makes substantial contributions to the existing literature in multiple ways. First, it employs the 2SGMM method to examine the effect of ownership on the simultaneous relationship between bank capital and the cost of financial intermediation (COFI). This study distinguishes itself from prior research, such as (Gharaibeh, 2023; Gupta et al., 2020; Mujtaba et al., 2021; Rastogi et al., 2021), by contributing a novel perspective to the existing body of knowledge. Second, we include quadratic terms for both capital and COFI to identify any nonlinearities in their relationship. We conduct a detailed analysis of these dynamics by categorizing capital and COFI into high, low, and average levels and employing dummy variables. Third, we analyze the effect of capital on COFI and vice versa in the context of different ownership structures. This is done by incorporating interaction terms between ownership and the capital ratio, as well as between ownership and the COFI ratio. Fourth, we assess the relevance of various theories, including the agency theory, agency cost hypothesis, charter value hypothesis, political view of government ownership, and social view of government ownership. We empirically examine how these theories manifest in the relationship between bank capital, COFI, and ownership structures in an emerging Asian economy. Finally, our findings extend beyond the specific emerging Asian economy under study, offering valuable insights for other emerging economies with similar economic conditions. This significantly enriches the academic discourse on banking regulation and performance in diverse economic environments.

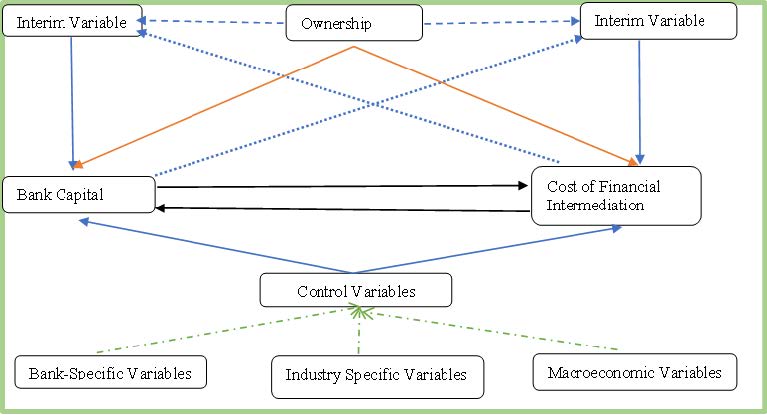

The visual representation of the research's theoretical structure is depicted below in Figure 1.

The rest of the paper is organized into four sections. Sections 2, 3, 4, and 5 encapsulate a literature review, methodology, empirical findings, and conclusion, respectively.

2.

Literature review

This segment covers a detailed literature analysis on capital, COFI, and ownership. Initially, we will show the theoretical bases of the study, and then, we will delve into studies that explore the association between capital and COFI. Finally, we will examine studies that shed light on the effect of ownership on capital and the COFI.

2.1. Theoretical bases

According to Berle and Means (1932), business owners enlist agents to manage their firms and handle daily operations. However, these agents may misuse company resources for personal gain, leading to a conflict between owners and agents. Ross (1973) identified the agency problem as related to decision-making and the expected outcomes of both principals and agents. The agency cost hypothesis states that having a higher capital ratio can effectively reduce agency costs as it motivates banks to prioritize the interest of shareholders (Berger & Bonaccorsi di Patti, 2006; Jensen & Meckling, 1976). Moreover, the charter value hypothesis suggests that increased efficiency generates economic rents, prompting shareholders to maintain larger equity capital holdings to protect these rents (Berger & Bonaccorsi di Patti, 2006). This hypothesis implies that higher profits motivate bank managers to strengthen capital reserves to mitigate potential liquidation risks (Ahmad & Albaity, 2019).

The dealership model of Ho and Saunder (1981) assumes that banks follow a consistent business strategy irrespective of ownership. However, agency theory posits that the ownership structure is vital in reducing agency conflicts. This is because concentrated ownership enables closer monitoring of managerial behavior, which helps to minimize agency costs (Shleifer & Vishny, 1997). Moreover, the political view of government ownership argues that state-owned banks are used for political purposes, which distorts financial resource allocation and may hinder productivity growth (La Porta et al., 2002; Sapienza, 2004). In contrast, the social view posits that while private banks prioritize profit, state-owned banks focus on financing socially important projects, promoting social development at the expense of profitability (Chen et al., 2016; Sapienza, 2004).

2.2. Literature concerning the association between capital and the COFI

In the aftershock of the financial crisis of 2007–2008, it is widely acknowledged by regulators and government officials alike that boosting capital levels is an essential step toward fortifying the stability and durability of banks (Basel Committee on Banking Supervision, 2009, 2010). Banks tend to operate as inspectors of quality for capital-seeking profitable initiatives in functional economies, guaranteeing greater returns and boosting progress (Dwumfour, 2017). The bank's net interest margin serves as both an indicator of its profitability and COFI (Marinkovic & Radovic, 2010). However, how banks set their COFI has been widely researched in the literature, which started thoroughly from the dealership model of Ho and Saunder (1981). They termed banks as the risk-averse intermediary and opined that the level of risk aversion, transaction magnitude, competition or structure of the market, and interest rate variances are the drivers of COFI. Multiple empirical research has examined and widened the dealership model, utilizing data from a single country or cross-country in the setting of developed and emerging nations (e.g., Allen, 1988; Angbazo, 1997; Cruz-García & Fernández de Guevara, 2019; Entrop et al., 2015; Maudos & Fernández de Guevara, 2004; McShane & Sharpe, 1985; Poghosyan, 2010).

Gupta et al. (2020) conducted a study to analyze the effects of capital on bank performance by using GMM estimation. They opined that well-capitalized banks perform better than low-capitalized banks. Soedarmono and Tarazi (2013) pinpointed the negative connection between the opacity and COFI of banks and opined that higher opacity inversely affects COFI where positively affected by capital. An empirical investigation of Mia (2023) on Bangladeshi commercial banks also finds the influence of capital on COFI. Investigating 32 commercial banks in Bangladesh, Rahman et al. (2018) preached that bank capital ratios have a significant positive relationship with the COFI, meaning that excessive capital needs cause banks to raise COFI. The positive effects of capital on the COFI were also found by Kanapiyanova et al. (2023), Shabir et al. (2023), Moudud-Ul-Huq (2021), Saif-Alyousfi and Saha (2021), and Al-Harbi (2019). Furthermore, research also evidenced a nonlinear relationship between capital and COFI. For instance, Haris et al. (2020) studied the effects of capital on the profitability of Pakistani commercial banks and found a nonlinear inverted U-shaped relationship between capital and COFI. Literature, for example, Ozili and Uadiale (2017) and Puspitasari et al. (2021), evidenced the insignificant impact of capital on COFI. Additionally, research indicates mixed effects of capital on the COFI (Balla & Rose, 2019; Rastogi et al., 2021).

On the other hand, over the past few years, numerous studies have explored the link between COFI and bank capital. According to Rahman et al. (2017), COFI positively impacts capital accumulation, supported by the findings of Moussa (2018). On the other hand, Ahmad et al. (2009) conducted a study in Malaysia between 1995 and 2002, which revealed a significant negative correlation between COFI and capital. This challenges the conventional belief that higher earnings contribute to equity capitalization intended for mitigating risk. Ahmad and Albaity (2019) and Mekonnen (2015) have also reported the negative effects of COFI on capital. However, Raharjo et al. (2014) found the impact of COFI on capital to be statistically insignificant. This lack of substantial association between COFI and bank capital was also observed in the study by Gharaibeh (2023). Furthermore, Aktas et al. (2015) conducted a study that revealed mixed evidence regarding the relationship between COFI and capital accumulation.

Given this ongoing debate, and following the charter value hypothesis, agency theory, and agency cost hypothesis, we assume the following associations between capital and COFI in hypothesis 1.

H1: Cost of financial intermediation (COFI) has a significant positive and nonlinear association with capital.

2.3. Literature concerning the effect of ownership on capital

Ownership structure reflects the benefits of shareholders and managers, significantly impacting an organization's operating and financial performance (Fleming et al., 2005). Banks' propensity to adjust their target capital ratios hinges on whether shareholders possess excess control rights (Lepetit et al., 2015). Moreover, studies advocate that choosing the proper capital structure helps lower agency expenses (Berger & Bonaccorsi di Patti, 2006).

Al-Hares et al. (2013) conducted a study on the quality of capital of Islamic and conventional commercial banks by using the bank-level data of 75 banks in the GCC region. They found that both types of banks in the area seem to fulfill the capitalization standards of Basel Ⅲ, with Islamic banks displaying notably elevated capital ratios compared to their conventional counterparts. The empirical investigation conducted by Jiang et al. (2019) revealed distinctive patterns in target capital ratios across different types of banks. Notably, government-owned banks demonstrate elevated target capital ratios and a more expeditious adjustment of these ratios when juxtaposed with private banks. These findings align with the political perspective, elucidating the government's role in shaping banking dynamics. Furthermore, the authors noted that undercapitalized government-owned banks opt for equity increases. In the examination of the intricate relationship between bank ownership and capital structure, with a focus on variables encompassing the quantum, maturity, and cost of debt, Fernández-Méndez and González (2019) asserted that bank ownership constitutes a substantial determinant in shaping firms' capital structures. Their insights suggest that bank ownership influences debt maturity and cost, consequently mitigating agency costs. Moreover, Mujtaba et al. (2021) opined that ownership concentration is positively linked with regulatory capital. Furthermore, government-owned banks play an important role in developing countries' financial systems. Nevertheless, their presence can negatively affect the performance of privately owned banks (Clarke et al., 2005). Iannotta et al. (2013) exposed that government banks are less capitalized than privately owned ones. Again, in GCC countries, state-owned banks outperform private-owned banks, whereas Islamic banks outperform conventional banks (Alshammari, 2022).

Given the diverse perspectives and following the agency theory and political views of state ownership, the following hypothesis is formulated:

H2: Ownership diversity has a significant impact on the capital of banks.

2.4. Literature concerning the effect of ownership on the COFI

The dealership model, initially proposed by Ho and Saunder (1981), posits that banks adhere to a consistent business strategy regardless of ownership. This model was later scrutinized and expanded upon by Fungáčová and Poghosyan (2011), who introduced the element of ownership structure. Their analysis of bank data from Russia spanning 1999 to 2007 revealed the significant influence of ownership structure on intermediation costs. Additionally, Toumi (2019) emphasized the value of the COFI as a predictive tool, particularly in distinguishing between Islamic and conventional commercial banks.

Gupta et al. (2020) studied ownership, capitalization, and bank performance using GMM estimation for the period 1998–2016 and revealed interesting insights. Notably, private-sector banks in India were found to be more profitable than their public-sector counterparts. Furthermore, the study highlighted the superior performance of small banks over large banks. The findings also indicated that the performance of public sector banks is less responsive to certain factors than private sector banks. Al-Hares et al. (2013) provided further evidence, showing that Islamic banks, despite lower efficiency, demonstrated higher solvency, profitability, liquidity, and internal growth rates than conventional banks. They also outperformed conventional banks during the global financial crisis of 2006–2009, attributed to their superior capitalization and liquidity reserves and more robust growth across most GCC countries. Rastogi et al. (2021) categorized ownership structures in banking into three groups: institutional ownership, promoter shareholder ownership, and retail investor ownership. Their study revealed that promoter shareholder ownership had significant positive effects on COFI, while institutional ownership had significant adverse effects on COFI. In contrast, retail investor shareholder ownership did not significantly impact COFI.

Given the diverse perspectives and following the agency theory and social views of state ownership, the following hypothesis is formulated:

H3: Ownership diversity has a significant positive effect on COFI.

Moreover, we also formulated the following hypothesis to show the effects of ownership on the relationship between bank capital and the COFI.

H4: The joint effects of ownership and COFI (capital) significantly impact the capital (COFI).

3.

Methodology of the study

This section delineates the data and variables utilized in the study and the techniques implemented for the empirical analysis.

3.1. Data and sample

We collected bank-level data from audited financial statements of respective banks' websites from 2010 to 2021. Additionally, industry-level and macroeconomic data were obtained from the World Bank dataset. The dataset includes detailed financial statements, covering balance sheets and income statements, as well as information on bank ownership types. There are 61 scheduled banks in Bangladesh, including specialized banks, state-owned commercial banks, foreign commercial banks, and private commercial banks (Bangladesh Bank, 2022; Gupta & Yesmin, 2022). All commercial banks were initially included as a sample, but the final sample list was generated using different screening. We excluded foreign commercial and specialized banks due to inconsistent reporting and data unavailability. The remaining banks were categorized by ownership into state-owned, private-owned, conventional, and Islamic banks. Banks not producing annual reports for at least five years were excluded to guarantee data quality and remove extreme outlier values from the dataset.

After implementing the specified filters, the resultant dataset is a robust and comprehensive unbalanced panel of 494 annual observations spanning 44 commercial banks from 2010 to 2021.

3.2. Description of variables

The variables used to investigate the relationship between bank capital, COFI, and ownership are shown in detail below:

3.2.1. Bank capital

Following the previous studies of Mehrotra et al. (2023), Abbas et al. (2023), and Mateev et al. (2021), to assess the bank capital, we utilized the eligible capital to total assets ratio to measure bank capital. In addition, we included a quadratic term of this measure to account for possible nonlinearities in the relationship between COFI and bank capital. To further explore the relationship, following the methodology of Tabak et al. (2012) and Mateev and Nasr (2023), we employed capital dummies categorized into three levels: high (≥¯Capital+0.5σCapital), average (>¯Capital−0.5σCapitaland<¯Capital+0.5σCapital), and low (≤¯Capital−0.5σCapital). We have also tested the model's resilience by using the capital adequacy ratio.

3.2.2. Cost of financial intermediation

The cost of financial intermediation (COFI), often captured by net interest margins, represents the difference between the interest income generated by banks from lending activities and the interest paid to depositors. While net interest margins can be viewed as a measure of bank profitability, they fundamentally represent the cost banks charge for their intermediation services. This cost is the spread between what banks pay for funds (deposits) and what they earn from lending those funds. Previous literature has consistently addressed net interest margins as a proxy for COFI (Gupta et al., 2021; Rahman et al., 2023; Rahman et al., 2018). Thus, COFI reflects the expenses banks incur in facilitating the flow of funds from savers to borrowers. We follow the literature of Gupta et al. (2021) and Rahman et al. (2023) to measure the COFI. We calculate COFI1 by taking the ratio of net interest income over total assets. A higher proportion of the variables indicates a higher COFI, and vice versa. To account for probable nonlinearities in the connection between bank capital and COFI, we have included a quadratic term of this COFI measure. Furthermore, we have used COFI dummies to explore the relationship further into three levels: high (≥¯COFI+0.5σCOFI), average (>¯COFI−0.5σCOFIand<¯COFI+0.5σCOFI), and low (≤¯COFI−0.5σCOFI). We have also tested the model's resilience by using the ratio of net interest income over total earning assets (COFI2).

Table 1 summarizes the estimated variables with sources and references noted in the last column.

3.3. Inflection point

We incorporated the squared terms of COFI and capital into various specifications to explore potential nonlinear relationships. Following Hussain and Bashir (2020), we calculated inflection points to interpret the results of these variables and their squared terms. To make sense of the results, we followed the interpretation approach of Berger et al. (2009), Hussain and Bashir (2020), and Zheng et al. (2023). An inflection point refers to the point (in slope) where the relationship between variables undergoes a substantial change, such as a transition from positive to negative or vice versa.

However, it is not rational to determine where the relationship between the two variables does not change, as this would require a reversal in the direction of their correlation (Khan & Senhadji, 2001).

3.4. Empirical research framework

This section discusses the study's empirical model, covering the baseline and extended bank capital and COFI models. Many researchers use equations based on a single dependent variable to examine the association between the dependent variable and various explanatory variables. However, this method often overlooks the simultaneity and endogeneity issues among the explanatory variables (Abbas et al., 2023). So, following the studies of Gupta et al. (2021) and Abbas et al. (2023), we specify the baseline equations model (simultaneous equations) to determine the interdependence between bank capital and the COFI.

where subscript i and t represent cross-sectional dimensions across banks and time, respectively. Again, q, r, s represent bank-specific, industry-specific, and macroeconomic-specific perspectives. B, I, and M are vectors of bank-specific, industry-specific, and macroeconomic-specific control variables, respectively. εi,tis the i.i.d (independent and identically distributed) error term.

Yi,t represents the dependent variable—capital and the COFI. Yi,t−1 signifies the lagged dependent variable. Xi,t refers to the endogenous independent variables. For the capital equation, the COFI is the endogenous independent variable, while for the COFI equation, capital is the endogenous independent variable. Bank-specific control variables are presented by Bi,q,t, which includes risk, income diversification, size, and profitability for capital measures; and includes risk, liquidity, size, and management efficiency for COFI measures. Ii,r,t presents the industry-specific variable, which includes BSD. Mi,s,tdenotes macroeconomic variables, including the GDP and inflation. The objective is to identify the simultaneous association between capital and the COFI, and determine the model variables to estimate equation (1) empirically. Table 1 describes the empirical proxy for each of these variables.

Following Arellano and Bover (1995), Blundell and Bond (1998), Rahman et al. (2017), and Moudud-Ul-Huq (2021), this study opted for a two-step system generalized method of moments (2SGMM) to avoid dynamic biases from ordinary least squares (OLS) methods (Nickell, 1981), the endogeneity problem from least square dummy variable (LSDV) methods, and the standard error fixed effects model (Alvi et al., 2021; Roodman, 2009). The 2SGMM addresses the model's endogeneity, heteroscedasticity, and the autocorrelation problem (Gupta & Yesmin, 2022; Zheng et al., 2018).

After conducting pre-diagnostic tests, it was discovered that using OLS as a regression method would not be advisable due to heteroscedasticity (White test for heteroscedasticity) and autocorrelation (LM test for autocorrelation). Instead, using the fixed-effect model based on the results of the Hausman specification tests is recommended. However, the assumption of OLS is rejected by the lagged dependent variables in equations (1) and (2), which restricts the use of the fixed effect model and first-step difference GMM. Therefore, following the recommended decisional procedure of Roodman (2009), we opt for the 2SGMM estimation technique of Arellano and Bover (1995) and Blundell and Bond (1998) to address the unobserved heterogeneity and endogeneity issue of unbalanced panel data. This method will provide unbiased and consistent results.

Two standard tests (Arellano and Bond 1 and 2, and the Hansen test) were conducted to ensure the model's accuracy. Additionally, the null hypothesis was examined through the AR (2) test to detect any second-order correlation between error terms. The p values of AR (2) revealed no second-order serial correlation in all of the applied models, consistent with findings by Rakshit and Bardhan (2019), Ben Naceur and Kandil (2009), and others.

We extend our baseline model based on the research of Liu et al. (2020), Gupta and Yesmin (2022), Moudud-Ul-Huq (2021), and Kasman and Kasman (2015) to analyze the nonlinear effect of the main independent variable and linear and nonlinear joint effect of the endogenous independent variable with ownership dummies on the dependent variables. Specifically, we included two ownership dummies: private commercial banks and Islamic commercial banks. These act as treatment variables, with counterparts assigned a value of 0 in the model. This allows us to compare private commercial banks with state-owned commercial banks and Islamic commercial banks with conventional commercial banks. The extended models are presented as follows:

Equation (3) presents the nonlinear effect of the main independent variable on the dependent variable. Equation (4) shows the effects of ownership on the dependent variables. Equations (5) and (6) present the combined effect of ownership and main independent variables on the dependent variables. In equation (3), X2i,t refers to the squared term of the dependent variables. In equation (6), the interaction of OWNP(OWNI)×X2i,t addresses the nonlinear and joint effect of the independent variable with the ownership dummy variables.

In this study, equations (2) through (6) are designed to address the research questions and test the specified hypotheses. Specifically, equations (2) and (3) are intended to test hypothesis 1 and reserve causality of capital, respectively. Equation (4) is formulated to evaluate hypotheses 2 and 3, while equations (5) and (6) are constructed to examine hypothesis 4.

3.5. Granger causality tests (GCT)

In line with previous studies of Fiordelisi et al. (2011), Barra and Ruggiero (2021), and others, we perform the GCT to explore the probable concurrent relationship between bank capital and COFI. Using the approaches of Granger (1969), we develop the following pairwise Granger causality models:

where Capitalt represents ECTA, COFIt represents COFI1, t denotes the time period (t = 1, 2, 3, ……, T), and j signifies the lag lengths. The error terms εi,t and ϵi,t are considered distinct white noise series. It is important to note that the Granger causality model does not include the extensive controls described in equations (2) through (6). Significance in the coefficients of the Capitali,t and COFIi,t in the above regressions indicates the presence of a bidirectional relationship or Granger causality between them (Granger, 1969). For lag selection, we adopt the ad hoc lag selection process of Jones (1989). As Table A1 in Appendix A shows, our results suggest that the bidirectional relationship between risk and capital may exist in all cases.

4.

Empirical findings

This section presents an overview of the statistics (Table 2), and multicollinearity tests (Tables 3–4). To determine the empirical results (Table 5–12), we utilized a 2SGMM panel estimator. We also employed the Hansen over-identification test to ensure the instruments' validity. Our instruments were verified as accurate in all Tables 5–12 specifications.

Table 4 presents the pairwise correlation between variables, while Table 3 reveals the results of the variance inflation factor test concerning capital and the COFI. We can state that multicollinearity is absent, with no correlation above 0.70 for any independent variables, and a ⅥF (variance inflation factor) value below 10 (Thompson et al., 2017).

4.1. Descriptive statistics

The descriptive statistics (Table 2) show that the average capital value is 10.6%, which is higher than both the US average of 8.9% (Berger et al., 2023) and the Asian average of 10.4% (Abbas et al., 2023). The mean value of the COFI is 2%, which is lower than the average for Central and Eastern European Countries of 3.52% (Agoraki & Kouretas, 2019), Asia Pacific of South Asia of 2.98% ((Islam & Nishiyama, 2016), and Asia Pacific of 3% (Fu et al., 2014). The mean value of the credit risk measure is 3.1%, which is lower than the Asian average of 4.5% (Abbas et al., 2023). The average liquidity value is 63.4%, higher than the average value of banks in the MENA region of 53.2% (Bougatef & Mgadmi, 2016) and 14 Muslim countries of 44.62% (Saeed et al., 2020). The mean value of management efficiency is 87.3%, which is higher than the average value of banks in BRICS countries of 85.97% (Rahman et al., 2017) but lower than the Egyptian bank's average of 92.9% (Ben Naceur & Kandil, 2009). On average, income diversity in Bangladeshi commercial banks is 2.5%. This indicates that the banking industry has stable funding sources and is protected from funding fragility. However, this value is higher than the 2.3% average for the MENA region (Mateev et al., 2021). The value of average profitability is 0.899%, which is higher than the Ghanaian banks' average of 0.19% (Carsamer et al., 2022). Industry-specific variables BSD depicts the average value of 48.044 with a standard deviation of 2.856. The average GDP is 5.122%, lower than the South Asian average of 5.97% (Islam & Nishiyama, 2016) and the Asian average of 4.112% (Abbas et al., 2023). However, the average inflation rate is 6.539% with a standard deviation of 1.532, higher than the Asian average of 5.612% (Abbas et al., 2023).

The regression outcomes for equations (2) through (6) are depicted across eight models in Tables 5, 7, 9, and 11. In Tables 6, 8, 10, and 12, we categorize the endogenous independent variables into three groups to show their possible effects on the dependent variables. In Table 5–12, standard errors are reported in parentheses. ***, **, and * denote the significance level at the corresponding 1%, 5%, and 10% level. The p-value of the Hansen test is also called the J statistic, and its null hypothesis suggests that the instruments used are not associated with the residuals (overidentifying restrictions). Tests for first-order (second-order) correlation using Arellano-Bond orders 1 and 2 are asymptotically N (0, 1). In the system GMM estimation, these test the first-differenced residuals.

4.2. Examination of the impact of COFI and ownership on bank capital

Table 5 demonstrates how the COFI and ownership affect bank capital. The regression coefficient of the lag-dependent variable is significant, meaning that the previous year's effect carries over to the current year, and the capital ratio remains stable. The positive relationship between the cost of financial intermediation and capital, in Model Ⅰ, implies that higher COFI leads to increased bank capital. This also means that increasing COFI provides managers with better access to capital. This result is consistent with the results of Rahman et al. (2017) but differs from the results of Ahmad et al. (2009). The coefficient value of risk shows a negative relationship between risk and capital. This negative relationship between risk and capital aligns with the results of Moudud-Ul-Huq et al. (2022). Profitability shows a significant positive effect on capital. The positive relationship supports the findings of Garel et al. (2022). The correlation between income diversification and bank capital suggests that banks with a broader range of revenue streams tend to have greater capital levels, indicating that diversification can be a valuable strategy for enhancing financial health. This finding is incongruent with the findings of Gupta et al. (2023). The coefficient of size clearly shows a negative relationship with capital, which indicates that as the size of the bank increases, its capital decreases. In other words, smaller banks may be able to maintain higher capital levels due to a more efficient capital structure relative to their size.

The industry-level variable BSD has a significant negative relationship with capital. It signifies that with the development of the banking sector, banks tend to maintain low proportionate capital. Both macroeconomic variables (GDP and inflation) have shown a significant negative relationship with capital. The negative association between GDP and capital implies that banks maintain lower capital in economic progression than otherwise. The outcome contrasts with the findings of Nguyen and Nghiem (2015). On the other hand, the negative relationship between inflation and capital is consistent with the findings of Alqahtani et al. (2016).

The empirical findings of equations (3)–(6) relate to nonlinear and joint effects of the COFI and ownership on bank capital are presented in Model (Ⅱ) to Model (Ⅷ) of Table 5. Specifically, Model (Ⅱ) examines the nonlinear effect of COFI, while Models (Ⅲ) and (Ⅵ) analyze the impact of ownership on bank capital. Additionally, Models (Ⅳ) and (Ⅶ) explore the joint effect of ownership and COFI, and Models (Ⅴ) and (Ⅷ) investigate the joint effect of ownership and the squared term of COFI on bank capital.

Model Ⅱ of Table 5 reveals a significant inverted U-shaped relationship between COFI and the bank capital. To assess the nature of the connection between the variables in the quadratic equation, we determine the inflection point and compare it to the data distribution. The inflection point of the equation is 0.0278, which surpasses the mean value of COFI and occurs at approximately the 75th percentile of the COFI distribution. This suggests a positive link between COFI and bank capital until the inflection point. However, once that point is exceeded, the relationship becomes negative. This finding partially accepts H1, which posited that COFI exhibits a significant positive impact on bank capital. Our finding supports as well as rejects the charter value hypothesis, which proposes that more efficient banks choose a high capital ratio and higher earnings provide bank managers easy access to capital and self-regulatory incentives for risk minimization (Berger & Bonaccorsi di Patti, 2006; Saunders & Wilson, 2001). Yu (2000) opined that, generally, a bank with a low probability of failure could generate more profit. Furthermore, we categorized COFI into high, average, and low categories to distinguish the possible relationships between COFI and bank capital. The results of the analysis, shown in columns Ⅰ, Ⅱ, and Ⅲ of Table 6, indicate that banks with average and low COFI can source more capital than those with high COFI.

In Model Ⅲ and Model Ⅵ of Table 5, the coefficient of the private ownership and Islamic ownership dummy shows a significant negative relationship with the bank's capital, meaning that the presence of private commercial banks and Islamic commercial banks have less significant effects in ensuring and sourcing more capital than the state-owned banks and conventional banks. These results validate H2, suggesting that the existence of privately owned commercial banks does not guarantee greater capital in the market than the state-owned banks. Conversely, findings also propose that Islamic commercial banks ensure more capital in the market. That validates the hypothesis that ownership diversity has a significant impact on the capital of banks.

In Model Ⅴ, the interaction of the private ownership dummy and COFI shows a significant negative relationship with bank capital, and the interaction of the private ownership dummy and squared term of COFI shows a significant positive relationship with bank capital indicating a U-shaped curve for private commercial banks. This finding also indicates a nonlinear inverted U-shaped relationship between COFI and bank capital for state-owned commercial banks. Again, in Model Ⅷ, the interaction of the Islamic ownership dummy and COFI shows a significant positive relationship with bank capital, and the interaction of Islamic ownership and the squared term of COFI shows a significant negative relationship with bank capital indicating an inverted U-shaped curve for Islamic commercial banks. This finding also indicates a nonlinear U-shaped relationship between COFI and bank capital for conventional commercial banks. These findings reveal that the inverted U-shaped relationship between COFI and bank capital is more pronounced in the state-owned banks and Islamic commercial banks, and state-owned banks and Islamic commercial banks can strengthen the nonlinear inverted U-shaped relationship between COFI and bank capital. On the other hand, these findings also indicate a nonlinear U-shaped relationship between COFI and bank capital for private commercial banks and conventional commercial banks.

Moreover, the findings from Model Ⅲ to Model Ⅷ of Table 5 reveal that private-owned commercial banks initially source less capital as COFI increases but can ultimately increase capital in the long run. On the contrary, though state-owned banks initially can source more capital as COFI rises, their capital base decreases in the long run. This decline is likely due to the poor performance of government banks (Cornett et al., 2010). This result is in line with the "political view of government ownership, " which suggests that state-owned banks are used to provide political sponsorship, which distorts the allocation of financial resources (Sapienza, 2004) and may harm productivity growth (La Porta et al., 2002). Again, the inverted U-shaped (U-shaped) curve for Islamic banks (conventional banks) indicates that Islamic banks (conventional banks) initially source more (less) capital as COFI increases but ultimately source less (more) capital in the long run. These findings mean that, in the long run, the capital of Islamic banks has decreased, which may be due to their poor performance. In contrast, conventional banks' capital has increased, which may be due to their better performance (see, e.g., Cornett et al. (2010)). These findings validate the hypothesis demonstrating the significant impact of the joint effect of ownership and COFI on capital.

4.3. Examination of the impact of bank capital and ownership on the COFI

Table 7 portrays the variables affecting the COFI and the effects of bank capital on COFI. The table reveals that the previous period's COFI has a positive and significant impact on COFI in subsequent periods. Additionally, a significant positive correlation between capital and COFI indicates that higher capital leads to a higher COFI. It signifies that banks raise/adjust the intermediation cost to cover their cost of capital (Rahman et al., 2018). Such a phenomenon may be attributed to the fact that capital is an expensive funding source, and having a significant amount of costly capital in the bank's overall capital structure necessitates a rise in COFI to cover their expenses or to safeguard shareholders against unexpected situations (Ben Naceur & Kandil, 2009). This result aligns with the findings of Shabir et al. (2023). Our findings support the agency cost hypothesis, which states that having a higher capital ratio can effectively reduce agency costs as it motivates banks to prioritize the interest of shareholders (Berger & Bonaccorsi di Patti, 2006; Jensen & Meckling, 1976).

Risk shows a significant negative relationship with COFI, which implies that increasing risk decreases banks' margins. This result is harmonized with the previous research conducted by Trinugroho et al. (2014). On the other hand, liquidity and COFI have a significant positive relationship, indicating that banks with higher liquidity must tend to have more operating expenses, which they then pass on to their borrowers. This outcome aligns with Ben Naceur and Kandil's (2009) findings. Moreover, size has a significant negative correlation with the COFI, indicating that larger banks cannot generate more COFI like the smaller banks can. This finding is aligned with the results of Rahman et al. (2023). Management efficiency shows a significant negative relationship with COFI, indicating that the more efficient banks tend to charge lower intermediation costs. This aligns with the earlier findings of Rahman et al. (2018).

Industry-specific variable BSD shows a significant positive relationship with the COFI. This result is incongruent with Gupta et al.'s (2021) findings. The macroeconomic variables GDP and inflation show a significant positive relationship with COFI. The positive relationship between GDP and COFI implies that as GDP increases, COFI also increases. This finding is aligned with the results of Hanzlík and Teplý (2020). The positive relationship between inflation and COFI implies that banks charge higher margins due to inflationary pressure. This finding is consistent with Entrop et al.'s (2015) findings.

The empirical findings of equations (3)–(6) related to nonlinear and joint effects of the bank capital and ownership on COFI are presented in Model (Ⅱ) to Model (Ⅷ) of Table 7. Specifically, Model (Ⅱ) examines the nonlinear effect of bank capital, while Models (Ⅲ) and (Ⅵ) analyze the impact of ownership on COFI. Additionally, Models (Ⅳ) and (Ⅶ) explore the joint effect of ownership and capital, and Models (Ⅴ) and (Ⅷ) investigate the joint effect of ownership and the squared term of capital on the COFI.

Model Ⅱ of Table 7 reveals a significant positive relationship between bank capital and COFI, and also a significant positive relationship between the squared term of bank capital and COFI, which indicates a significant nonlinear positive effect of bank capital on the COFI (see, e.g., Deng et al., 2022; Kimeldorf et al., 1982). This suggests that as bank capital increases, COFI experiences a positive impact that strengthens as capital levels rise. This finding also indicates that well-capitalized banks can typically generate more COFI to offset their cost of capital compared to banks with lower capital, both in the short and long term. Unlike section 4.2, here, it is not rational to determine where the relationship between the two variables does not change, as this would require a reversal in the direction of their correlation (Khan & Senhadji, 2001). Therefore, the inflection point cannot be measured here. This finding supports H1, which posits that capital has a significant nonlinear relationship with COFI. Our findings support the agency cost hypothesis, which states that having a higher capital ratio can effectively reduce agency costs as it motivates banks to prioritize the interest of shareholders (Berger & Bonaccorsi di Patti, 2006; Jensen & Meckling, 1976). Furthermore, we categorized capital into high, average, and low categories to distinguish the possible relationships between bank capital and COFI. The results of the analysis, shown in columns Ⅰ, Ⅱ, and Ⅲ of Table 8, indicate that banks with high and average capital can generate more COFI than those with low capital.

In Model Ⅲ and Model Ⅵ of Table 7, the coefficient of the private ownership dummy and Islamic ownership dummy shows a significant positive relationship with the COFI, meaning that the presence of private commercial and Islamic commercial banks has a more substantial impact on the bank's COFI than state-owned and conventional banks. These findings confirm H3. These suggest that the presence of privately owned commercial banks and Islamic commercial banks has a notable positive impact on COFI and can minimize agency conflicts better than their counterparts. Moreover, Model Ⅴ reveals that the interaction between the private ownership dummy and bank capital significantly positively affects COFI. Furthermore, the interaction between private ownership and the squared term of bank capital also exhibits a significant positive association with COFI. Hence, it indicates a nonlinear positive relationship between bank capital and COFI for privately owned banks. This finding also indicates a nonlinear negative association between capital and COFI for state-owned banks and suggests that private-owned banks experience more benefits in COFI from capital increases than state-owned banks. Our findings support the "social view of government ownership" (Sapienza, 2004). This ownership view distinguishes the private and state-owned banks, with private banks maximizing profits and state-owned banks contributing to social development. According to this theory, state-owned banks aim to finance socially significant projects (Sapienza, 2004), even if doing so does not maximize profit (Chen et al., 2016). On the other hand, private-owned commercial banks are gaining more COFI to cover their expenses and protect shareholders from unforeseen situations. These findings support the agency cost hypothesis (Berger & Bonaccorsi di Patti, 2006; Jensen & Meckling, 1976).

The results from Model Ⅷ reveal interesting insights into the relationship between bank capital and COFI for both Islamic banks and conventional banks. Specifically, the study evidences that Islamic banks exhibit a nonlinear inverted U-shaped relationship between bank capital and COFI, while conventional banks display a U-shaped relationship. This finding means that while well-capitalized Islamic banks generate more COFI in the short term, well-capitalized conventional banks tend to generate more COFI in the long run, as they increase their COFI over time to cover capital costs and safeguard their shareholders from unforeseen situations. Considering the long-run effect, these findings align with the agency cost hypothesis for the conventional bank. (Berger & Bonaccorsi di Patti, 2006; Jensen & Meckling, 1976). However, the findings also suggest that the effects of capital on the COFI of Islamic commercial banks do not align with the agency cost hypothesis in the long run. This may be because maximizing shareholder profit is not the only objective of Islamic banks, according to the principles and characteristics of Islamic banking law. Furthermore, traditional agent views do not align with Islamic bank governance, and the Shariah Supervisory Board plays a key role in developing agency relationships in Islamic banks (Al-Nasser Mohammed & Muhammed, 2017). These findings validate H4 demonstrating the significant impact of the joint effect of ownership and capital on COFI.

4.4. Robustness test

We conduct a thorough robustness check to ensure the accuracy of our main discoveries. To accomplish this, we follow the study of Shabir et al. (2023), Gupta et al. (2023), Zheng et al. (2017b), and Alves et al. (2023). We used alternate specifications of the dependent variable to confirm the validity of our main findings. Specifically, we use the capital adequacy ratio as an alternative proxy for bank capital. Moreover, we use net interest income to average earning assets (COFI2) as an alternative proxy for COFI. The results of our re-estimated equations (2) to (6) using these proxies are presented in Tables 9 to 12. The impact of COFI and ownership on bank capital is showcased in Table 9, while the effects of different COFI categories on bank capital are displayed in Table 10. Table 11 demonstrates the impact of bank capital and ownership on COFI. Finally, Table 12 presents the effect of varying capital categories on COFI

4.4. Discussion on the key findings

Our study aims to understand the impact of ownership on the association between bank capital and the cost of financial intermediation. The descriptive statistics reveal that the variables conform to a normal distribution, with both the mean and standard deviation values appearing promising. Notably, BSD has a higher standard deviation, while COFI1 has a lower one. Moreover, the correlation matrix and variance inflation factor demonstrate no multicollinearity in the dataset, and the variable relationship is typical. We employ the highly efficient and dependable two-step system GMM technique to acquire results, and we also carry out a robustness test using alternative proxies of dependent variables. The analysis shows that COFI has a significant positive effect on bank capital, which aligns with the findings of Rahman et al. (2017) but differs from the results of Ahmad et al. (2009). The analyses show that higher COFI increases bank capital and gives managers better access to capital. Our study also uncovered a significant inverted U-shaped relationship between COFI and bank capital. In other words, there is a positive link between COFI and the bank until the inflection point, after which the relationship becomes negative. This finding partially accepts H1, and also supports and contradicts the charter value hypothesis, which suggests that more efficient banks opt for a high capital ratio, and higher earnings provide bank managers with easy access to capital and self-regulatory incentives for risk minimization (Berger & Bonaccorsi di Patti, 2006; Saunders & Wilson, 2001). Additionally, banks with average and low COFI can source more capital than those with high COFI levels. On the other hand, capital has a significant positive effect on the COFI, corresponding with previous findings of Shabir et al. (2023). This finding indicates that higher capital leads to a higher COFI. We also observe a significant, nonlinear positive correlation between capital and COFI, meaning that as banks increase their capital, COFI experiences a progressively stronger impact. This result suggests that well-capitalized banks are better equipped to generate COFI and offset their cost of capital than their less-capitalized counterparts in the short and long term. Our results support the agency cost hypothesis by demonstrating that a higher capital ratio can reduce agency costs and motivate banks to prioritize shareholder interests (Berger & Bonaccorsi di Patti, 2006; Jensen & Meckling, 1976). Additionally, banks with average capital can generate more COFI than those with high and low COFI.

Again, our findings reveal that the presence of private commercial banks and Islamic commercial banks have less significant effects on ensuring and sourcing more capital than state-owned and conventional banks. Specifically, our analysis suggests an inverted U-shaped relationship between COFI and bank capital, which is more pronounced in state-owned and Islamic commercial banks. The presence of these types of banks further strengthens this nonlinear relationship. Again, privately owned commercial banks exhibit a nonlinear U-shaped relationship between COFI and bank capital. These results suggest that while state-owned banks can initially source more capital as COFI rises, their capital base may decrease in the long run due to poor performance. Conversely, privately owned commercial banks may initially source less capital as COFI increases but can increase their capital in the long run. The inverted U-shaped (U-shaped) curve for Islamic (conventional) banks indicates that they initially source more (less) capital as COFI increases but ultimately can source less (more) capital in the long run. These findings suggest that, in the long run, the capital of Islamic banks decreases as COFI rises, possibly due to their poor performance. On the other hand, conventional banks have seen increased capital, possibly due to their better performance in the long run (see, e.g., Cornett et al. (2010). These results support our third hypothesis and also align with the political view of state ownership.

Furthermore, our study has shown that the presence of private commercial banks and Islamic commercial banks have more significant effects on COFI than the state-owned and conventional banks. The study also identifies that private-owned banks have a nonlinear positive relationship between bank capital and COFI, which suggests that they may experience more benefits in COFI from capital increases than the state-owned banks. However, private-owned commercial banks are gaining more COFI to cover expenses and protect shareholders from unforeseen situations. Islamic banks exhibit a nonlinear inverted U-shaped relationship between bank capital and COFI, while conventional banks display a U-shaped relationship. The findings mean that while well-capitalized Islamic banks may generate more COFI in the short term, well-capitalized conventional banks tend to generate more COFI in the long term as they increase their COFI over time to cover capital costs and safeguard their shareholders from unforeseen situations. These findings support our third hypothesis and also align with the social view of government ownership and the agency cost hypothesis.

5.

Conclusions

This study empirically examines how ownership influences the relationship between bank capital and the COFI Bangladeshi banks from 2010 to 2021. Several studies focused on individual capital and the COFI measures, ignoring the simultaneous relationship between capital and the COFI and the ownership effect on that nexus. To fill this gap, we investigated the mediating role of ownership in the concurrent relationship between bank capital and the COFI in an emerging economy. This study considered bank capital and the cost of financial intermediation as dependent variables, while ownership, banking sector development (BSD), GDP, inflation, risk, income diversification, bank size, profitability, liquidity, and management efficiency were independent variables. To identify potential nonlinear effects, we categorized the bank capital and COFI variables into high, average, and low categories. Given the nature of the data and pre-diagnostic tests, we employed the two-step system GMM for regression analysis. To ensure the validity of our findings, we conducted a robustness check using different specifications for the dependent variables.

The study's findings specified a significant bidirectional nonlinear relationship between bank capital and the cost of financial intermediation. This suggests an optimum COFI level where sourcing capital can be maximized. However, due to bank capital's nonlinear and consistent effects on COFI, our research does not provide any evidence to determine an optimal capital level for maximum COFI. Our specifications do not provide any evidence for defining the optimal capital level or COFI level. Our findings support the agency cost hypothesis and also support as well as reject the charter value hypothesis. Our results suggest that banks with average and low COFI can source more capital than those with high COFI and that banks with high and average capital can maximize their COFI compared to those with low capital bases.

Our study provided significant evidence of the ownership effect on the simultaneous relationship between capital and COFI. Our findings indicated that state-owned and conventional commercial banks are better positioned to source capital. The state-owned banks and Islamic commercial banks strengthen the inverted U-shaped relationship between COFI and bank capital than private-owned and conventional commercial banks. Additionally, our study showed that state-owned banks are more adept at acquiring capital when COFI rises. However, their capital foundations tend to decrease gradually, aligning with the "political view of government ownership" (Sapienza, 2004). Our results also indicated that the capital of Islamic banks has decreased with the increase of COFI in the long run, which can be attributed to their poor performance. On the other hand, conventional commercial banks have experienced increased capital in the long run as COFI has gone up, which could be attributed to their superior performance (see, e.g., (Cornett et al., 2010)).

Again, when considering the effect of capital on the COFI with ownership effects, the study discovered that private commercial banks have a more significant effect on strengthening the nonlinear positive relationship between bank capital and COFI than state-owned commercial banks. In addition, the study found that state-owned banks do not experience the same benefits in COFI from capital increases as privately owned banks, which supports the "social view of government ownership". The study also showed that conventional commercial banks increase their COFI over time to cover the cost of capital and protect their shareholders from unforeseen situations, aligning with the agency cost hypothesis. However, the long-run effects of capital on the COFI of Islamic banks do not support the agency cost hypothesis, possibly due to the principles and characteristics of Islamic banks.

The findings of this study highlighted the heterogeneous bi-directional interrelationship between capital and the COFI, considering the ownership effect. So, the results provide significant policy implications, particularly for emerging nations like Bangladesh. Banks behave differently regarding charging for financial intermediation at different periods. Therefore, policymakers should closely monitor the behavior and incentives of different banks to ensure an efficient market, encouraging them to share information appropriately. In addition, regulators should be vigilant about banks' capital financing. While higher capital can minimize risk and strengthen shareholder value, it can also increase the banks' weighted average cost of capital, raising the COFI. Moreover, banks must exercise prudence in capital financing and charging margins, considering market segmentation based on depositors' and borrowers' qualities and capabilities (Dell'Ariccia & Marquez, 2004). Policymakers and regulators must keep a watchful eye on banks to ensure a fair and efficient financial system.

In conclusion, this study solely examined the influence of ownership on the capital-COFI relationship within a single nation and did not consider the transnational ramifications. However, we intend to explore this aspect in future research endeavors.

Use of AI tools declaration

The authors declare that no Artificial Intelligence (AI) tools were utilized in developing this article.

Acknowledgements

This research received no grants from public, commercial, or not-for-profit sectors.

Conflicts of Interest

All authors declare no conflicts of interest.

Author contributions

Conceptualization: Changjun Zheng, Md Mohiuddin Chowdhury, and Anupam Das Gupta;

Methodology: Md Mohiuddin Chowdhury. and Anupam Das Gupta;

Formal Analysis: Md Mohiuddin Chowdhury. and Anupam Das Gupta;

Original Draft Preparation: Md Mohiuddin Chowdhury;

Review and Editing: Md Mohiuddin Chowdhury, Changjun Zheng, and Anupam Das Gupta;

Supervision: Changjun Zheng

Appendix A

DownLoad:

DownLoad: